SPOILER ALERT!

Here Are 5 Common Blunders To Watch Out When Teaming Up With An Insurance Policy Broker:

Writer-Bendsen Duffy

When it comes to collaborating with an insurance policy broker, steering clear of typical errors can make a significant distinction in the insurance coverage you get. Ensuring that you have the ideal plan information in position can be a game-changer, but that's simply the tip of the iceberg when it comes to browsing the insurance policy landscape efficiently.

By sidestepping these challenges, you can protect your interests and make informed decisions that align with your requirements and budget.

Familiarize on your own with these usual blunders and take steps to prevent them:

1. Poor communication: Make sure that you clearly share your needs and expectations to your broker. Avoid thinking that they comprehend your requirements without confirming them.

2. Insufficient study: Do not rush into a decision without properly vetting your broker and their options. Conduct thorough research study to find the very best fit for your needs.

3. Absence of openness: Be open and truthful with your broker about your spending plan, constraints, and any other pertinent information. This will help them give you with one of the most ideal options.

4. http://earnest53prince.xtgem.com/__xt_blog/__xtblog_entry/__xtblog_entry/36296009-distinctions-between-insurance-policy-brokers-and-insurance-representatives-what-establishes-them-apart?__xtblog_block_id=1#xt_blog to compare options: Do not go for the first option presented to you. Make the effort to compare different policies and rates to locate the best value.

5. Not reviewing the fine print: Make sure to thoroughly assess the policy information and terms prior to authorizing anything. Don't allow misconceptions or concealed charges sneak up on you.

Don't overlook the significance of completely reviewing all policy details when dealing with an insurance policy broker. It's simple to get caught up in the excitement of locating the appropriate insurance coverage and avoid over the small print. However, stopping working to take note of the specifics of your policy can lead to expensive blunders down the line.

Ensure you recognize what's covered, any type of constraints or exemptions, in addition to the procedure for suing. Ask inquiries if anything is vague and do not think twice to request information from your broker.

When you hurry via the insurance plan evaluation procedure, you might lose out on important insights that come from contrasting numerous quotes.

Not taking the time to collect and contrast quotes from various insurance coverage suppliers can bring about missed out on chances for expense savings and much better coverage choices.

Each insurer has its own distinct prices structure and coverage offerings, so by only taking into consideration one choice, you could be limiting your ability to locate the most effective bargain for your certain needs.

By contrasting multiple quotes, you can make sure that you're getting the most competitive prices and one of the most comprehensive coverage readily available in the marketplace.

Take the time to discover your alternatives and make an educated choice based on an extensive contrast of quotes.

Bear in mind possible insurance coverage voids when reviewing your insurance plan to make sure thorough protection for your properties and obligations.

Ignoring coverage spaces can leave you vulnerable to unanticipated costs or losses. One usual blunder is thinking that certain risks are instantly covered when they might require extra recommendations or separate policies.

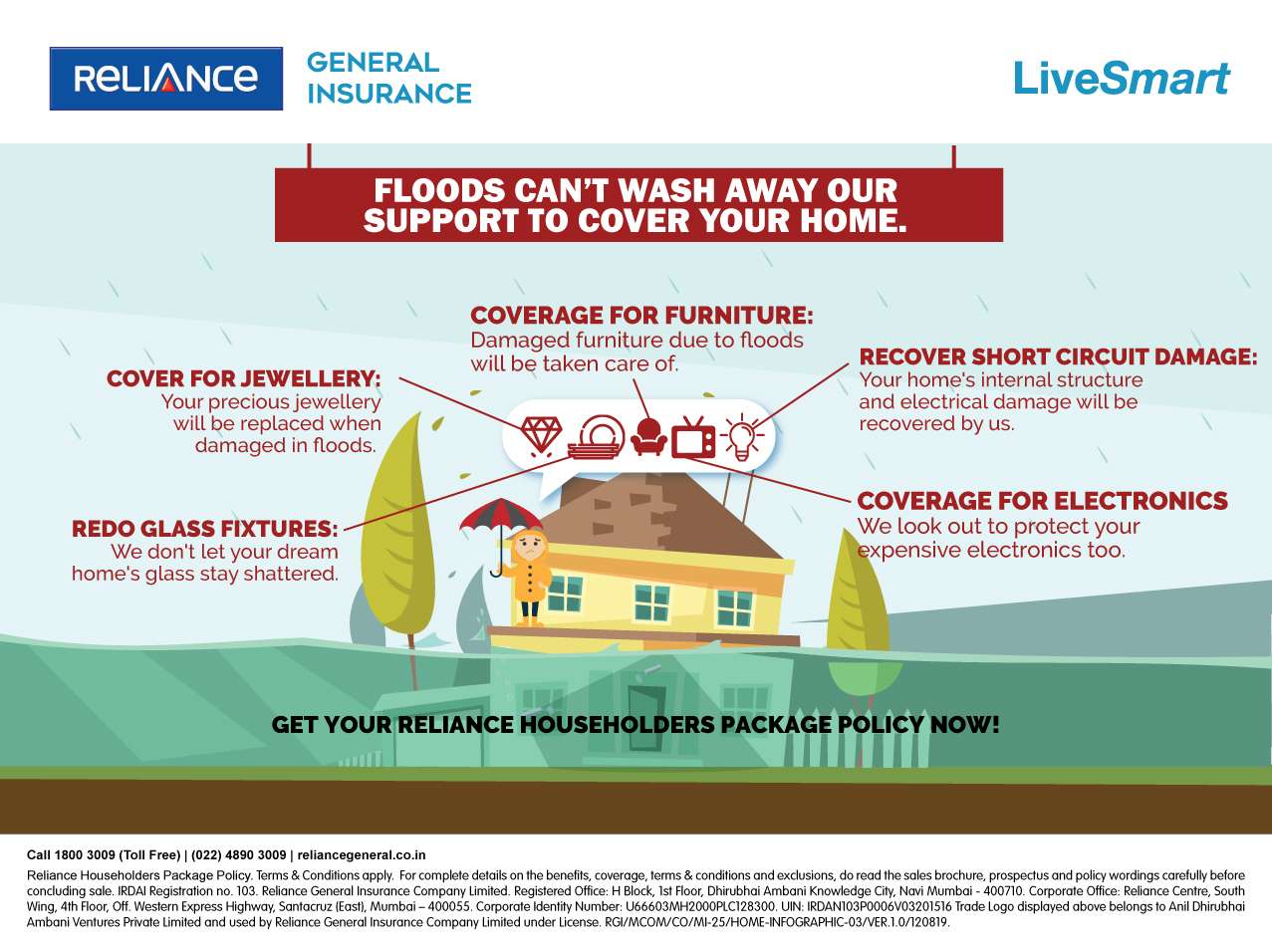

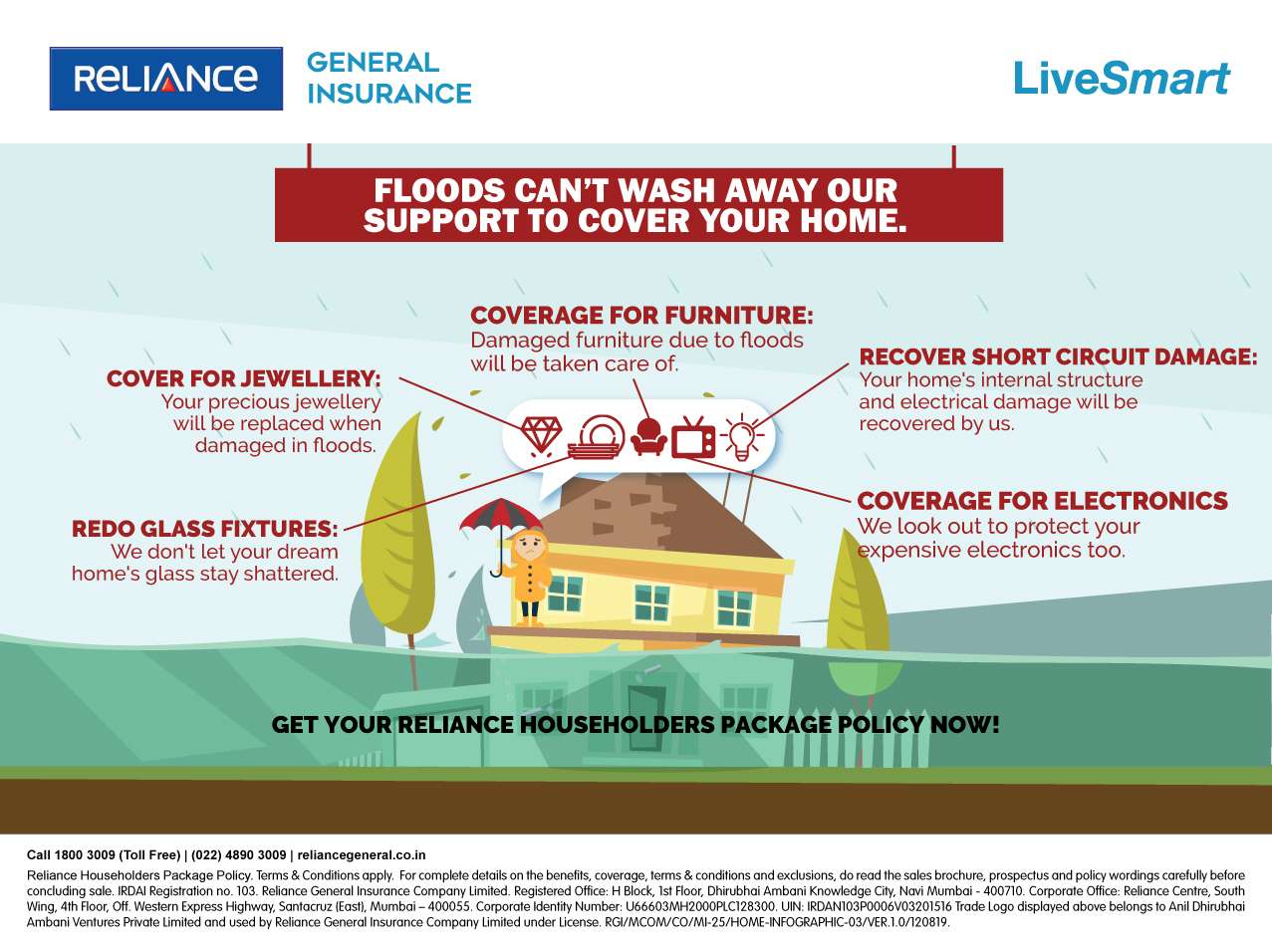

As an example, your typical property owner's insurance policy mightn't cover floods or earthquakes, so it's essential to evaluate if you need additional protection for these specific risks.

In a similar way, in business insurance coverage, forgeting vital elements like organization disruption protection or cyber responsibility insurance policy could leave your business subjected to considerable monetary risks.

Ensure clear and in-depth communication with your insurance coverage broker to precisely convey your protection demands and assumptions. Failing to clearly interact your demands can lead to misunderstandings and insufficient insurance coverage.

When discussing your insurance needs, be specific about your possessions, threats, and any kind of one-of-a-kind circumstances that might impact your insurance coverage. Supply exact details concerning your home, vehicle, or service to guarantee that your broker can use suitable options.

Plainly articulate your budget plan constraints, desired protection limits, and any type of certain recommendations you may call for. By freely reviewing your requirements and concerns, you can work together with your broker to find the very best insurance policy solutions customized to your private scenario.

Effective communication is key to getting the appropriate coverage for your insurance policy needs.

To prevent prospective spaces in your insurance coverage and guarantee your insurance coverage aligns with your developing needs, on a regular basis evaluating your plans each year is crucial. Skipping annual policy evaluations can lead to overlooked modifications in your conditions, leaving you underinsured or spending for insurance coverage you no more need.

By scheduling these annual reviews, you give on your own the chance to assess any type of changes required to maintain your policies approximately date. Life occasions, such as marrying, having kids, or purchasing a brand-new home, can dramatically affect your insurance policy needs.

Putting in the time to examine your plans with your insurance coverage broker ensures you have the ideal coverage in position and peace of mind recognizing you're effectively shielded.

Flood Zone Insurance Cost

Do not let these usual mistakes lead you astray when collaborating with an insurance policy broker. Take notice of policy information, compare quotes, address protection voids, connect plainly, and review your policy each year.

By staying clear of these mistakes, you'll guarantee you're obtaining the very best coverage for your demands. Remember, ignoring these factors is like driving blindfolded with a maze of insurance policy options - high-risk and possibly disastrous.

So, remain notified and make Condo Insurance Coverage !

When it comes to collaborating with an insurance policy broker, steering clear of typical errors can make a significant distinction in the insurance coverage you get. Ensuring that you have the ideal plan information in position can be a game-changer, but that's simply the tip of the iceberg when it comes to browsing the insurance policy landscape efficiently.

By sidestepping these challenges, you can protect your interests and make informed decisions that align with your requirements and budget.

Familiarize on your own with these usual blunders and take steps to prevent them:

1. Poor communication: Make sure that you clearly share your needs and expectations to your broker. Avoid thinking that they comprehend your requirements without confirming them.

2. Insufficient study: Do not rush into a decision without properly vetting your broker and their options. Conduct thorough research study to find the very best fit for your needs.

3. Absence of openness: Be open and truthful with your broker about your spending plan, constraints, and any other pertinent information. This will help them give you with one of the most ideal options.

4. http://earnest53prince.xtgem.com/__xt_blog/__xtblog_entry/__xtblog_entry/36296009-distinctions-between-insurance-policy-brokers-and-insurance-representatives-what-establishes-them-apart?__xtblog_block_id=1#xt_blog to compare options: Do not go for the first option presented to you. Make the effort to compare different policies and rates to locate the best value.

5. Not reviewing the fine print: Make sure to thoroughly assess the policy information and terms prior to authorizing anything. Don't allow misconceptions or concealed charges sneak up on you.

Ignoring Plan Facts

Don't overlook the significance of completely reviewing all policy details when dealing with an insurance policy broker. It's simple to get caught up in the excitement of locating the appropriate insurance coverage and avoid over the small print. However, stopping working to take note of the specifics of your policy can lead to expensive blunders down the line.

Ensure you recognize what's covered, any type of constraints or exemptions, in addition to the procedure for suing. Ask inquiries if anything is vague and do not think twice to request information from your broker.

Not Contrasting Multiple Quotes

When you hurry via the insurance plan evaluation procedure, you might lose out on important insights that come from contrasting numerous quotes.

Not taking the time to collect and contrast quotes from various insurance coverage suppliers can bring about missed out on chances for expense savings and much better coverage choices.

Each insurer has its own distinct prices structure and coverage offerings, so by only taking into consideration one choice, you could be limiting your ability to locate the most effective bargain for your certain needs.

By contrasting multiple quotes, you can make sure that you're getting the most competitive prices and one of the most comprehensive coverage readily available in the marketplace.

Take the time to discover your alternatives and make an educated choice based on an extensive contrast of quotes.

Overlooking Coverage Gaps

Bear in mind possible insurance coverage voids when reviewing your insurance plan to make sure thorough protection for your properties and obligations.

Ignoring coverage spaces can leave you vulnerable to unanticipated costs or losses. One usual blunder is thinking that certain risks are instantly covered when they might require extra recommendations or separate policies.

As an example, your typical property owner's insurance policy mightn't cover floods or earthquakes, so it's essential to evaluate if you need additional protection for these specific risks.

In a similar way, in business insurance coverage, forgeting vital elements like organization disruption protection or cyber responsibility insurance policy could leave your business subjected to considerable monetary risks.

Failing to Communicate Demands Plainly

Ensure clear and in-depth communication with your insurance coverage broker to precisely convey your protection demands and assumptions. Failing to clearly interact your demands can lead to misunderstandings and insufficient insurance coverage.

When discussing your insurance needs, be specific about your possessions, threats, and any kind of one-of-a-kind circumstances that might impact your insurance coverage. Supply exact details concerning your home, vehicle, or service to guarantee that your broker can use suitable options.

Plainly articulate your budget plan constraints, desired protection limits, and any type of certain recommendations you may call for. By freely reviewing your requirements and concerns, you can work together with your broker to find the very best insurance policy solutions customized to your private scenario.

Effective communication is key to getting the appropriate coverage for your insurance policy needs.

Skipping Annual Policy Reviews

To prevent prospective spaces in your insurance coverage and guarantee your insurance coverage aligns with your developing needs, on a regular basis evaluating your plans each year is crucial. Skipping annual policy evaluations can lead to overlooked modifications in your conditions, leaving you underinsured or spending for insurance coverage you no more need.

By scheduling these annual reviews, you give on your own the chance to assess any type of changes required to maintain your policies approximately date. Life occasions, such as marrying, having kids, or purchasing a brand-new home, can dramatically affect your insurance policy needs.

Putting in the time to examine your plans with your insurance coverage broker ensures you have the ideal coverage in position and peace of mind recognizing you're effectively shielded.

Flood Zone Insurance Cost

Do not let these usual mistakes lead you astray when collaborating with an insurance policy broker. Take notice of policy information, compare quotes, address protection voids, connect plainly, and review your policy each year.

By staying clear of these mistakes, you'll guarantee you're obtaining the very best coverage for your demands. Remember, ignoring these factors is like driving blindfolded with a maze of insurance policy options - high-risk and possibly disastrous.

So, remain notified and make Condo Insurance Coverage !