SPOILER ALERT!

Understanding The Different Sorts Of Insurance Policies As A Representative

Article by-Gustafsson Vega

Insurance coverage is a vital investment that shields you and also your possessions from economic loss. Best Home Insurance Companies and also companies can help you recognize the various kinds of insurance policies available to fulfill your demands.

Representatives describe the different options of insurer as well as can finish insurance policy sales (bind insurance coverage) on your behalf. Independent representatives can work with several insurance coverage service providers, while slave or unique insurance policy representatives stand for a solitary business.

If you're aiming to purchase a specific type of insurance coverage, you can connect with restricted agents that work with one specific supplier. These representatives offer just the policies supplied by their employer, which makes them specialists in the kinds of coverage as well as discount rates provided.

They likewise have a strong partnership with their company and also are frequently needed to satisfy sales allocations, which can impact their ability to aid clients objectively. They can supply a variety of policies that fit your needs, yet they won't be able to provide you with quotes from various other insurance companies.

Restricted agents usually collaborate with big-name insurance companies such as GEICO, State Farm as well as Allstate. They can be a fantastic source for customers who wish to support local businesses as well as develop a long-lasting connection with a representative that recognizes their area's distinct threats.

Independent agents commonly work with multiple insurer to sell their customers' plans. This allows them to provide a more tailored as well as customizable experience for their clients. They can additionally help them re-evaluate their coverage in time and advise brand-new policies based upon their demands.

They can supply their customers a range of plan choices from several insurance carriers, which indicates they can offer side-by-side comparisons of pricing and also protection for them to choose from. They do this with no ulterior motive and can help them discover the plan that actually fits their unique needs.

The very best independent agents understand all the ins and outs of their different product and are able to respond to any kind of questions that turn up for their customers. This is an indispensable service as well as can conserve their clients time by taking care of all the details for them.

Life insurance policy plans usually pay money to assigned beneficiaries when the insured passes away. The recipients can be an individual or organization. Individuals can get life insurance plans directly from a personal insurance provider or with group life insurance policy provided by companies.

The majority of life insurance plans need a medical exam as part of the application procedure. Simplified problem and also ensured concerns are available for those with health problems that would certainly or else avoid them from obtaining a traditional policy. Long-term policies, such as entire life, include a savings element that gathers tax-deferred and may have higher costs than term life plans.

Whether offering a pure security strategy or a much more complicated life insurance policy plan, it is very important for a representative to fully understand the attributes of each item as well as how they associate with the customer's particular scenario. This helps them make enlightened referrals and prevent overselling.

Health insurance is a system for funding medical expenses. It is commonly financed with contributions or tax obligations and also provided through personal insurers. Exclusive health insurance can be purchased separately or through group plans, such as those offered via companies or expert, public or spiritual teams. Some kinds of health coverage include indemnity strategies, which reimburse policyholders for particular costs up to a set restriction, handled care strategies, such as HMOs and also PPOs, and also self-insured strategies.

As a representative, it is important to understand the various types of insurance plan in order to help your customers locate the most effective choices for their needs as well as budgets. Nevertheless, blunders can take place, as well as if a mistake on your component triggers a client to lose cash, mistakes as well as omissions insurance policy can cover the price of the suit.

Long-lasting care insurance helps people pay for home health assistant solutions and retirement home care. It can also cover a part of the expense for assisted living and also other household treatment. Plans normally cap how much they'll pay each day and over a person's lifetime. Some policies are standalone, while others integrate protection with various other insurance coverage items, such as life insurance policy or annuities, and also are known as hybrid policies.

please click the up coming article of private long-lasting treatment insurance policies need medical underwriting, which indicates the insurance provider requests personal info and may request documents from a physician. A preexisting condition might omit you from getting advantages or could trigger the policy to be terminated, professionals caution. Best Insurance For Off Road Vehicles provide a rising cost of living cyclist, which increases the daily advantage amount on an easy or compound basis.

Insurance coverage is a vital investment that shields you and also your possessions from economic loss. Best Home Insurance Companies and also companies can help you recognize the various kinds of insurance policies available to fulfill your demands.

Representatives describe the different options of insurer as well as can finish insurance policy sales (bind insurance coverage) on your behalf. Independent representatives can work with several insurance coverage service providers, while slave or unique insurance policy representatives stand for a solitary business.

Captive Representatives

If you're aiming to purchase a specific type of insurance coverage, you can connect with restricted agents that work with one specific supplier. These representatives offer just the policies supplied by their employer, which makes them specialists in the kinds of coverage as well as discount rates provided.

They likewise have a strong partnership with their company and also are frequently needed to satisfy sales allocations, which can impact their ability to aid clients objectively. They can supply a variety of policies that fit your needs, yet they won't be able to provide you with quotes from various other insurance companies.

Restricted agents usually collaborate with big-name insurance companies such as GEICO, State Farm as well as Allstate. They can be a fantastic source for customers who wish to support local businesses as well as develop a long-lasting connection with a representative that recognizes their area's distinct threats.

Independent Brokers

Independent agents commonly work with multiple insurer to sell their customers' plans. This allows them to provide a more tailored as well as customizable experience for their clients. They can additionally help them re-evaluate their coverage in time and advise brand-new policies based upon their demands.

They can supply their customers a range of plan choices from several insurance carriers, which indicates they can offer side-by-side comparisons of pricing and also protection for them to choose from. They do this with no ulterior motive and can help them discover the plan that actually fits their unique needs.

The very best independent agents understand all the ins and outs of their different product and are able to respond to any kind of questions that turn up for their customers. This is an indispensable service as well as can conserve their clients time by taking care of all the details for them.

Life Insurance

Life insurance policy plans usually pay money to assigned beneficiaries when the insured passes away. The recipients can be an individual or organization. Individuals can get life insurance plans directly from a personal insurance provider or with group life insurance policy provided by companies.

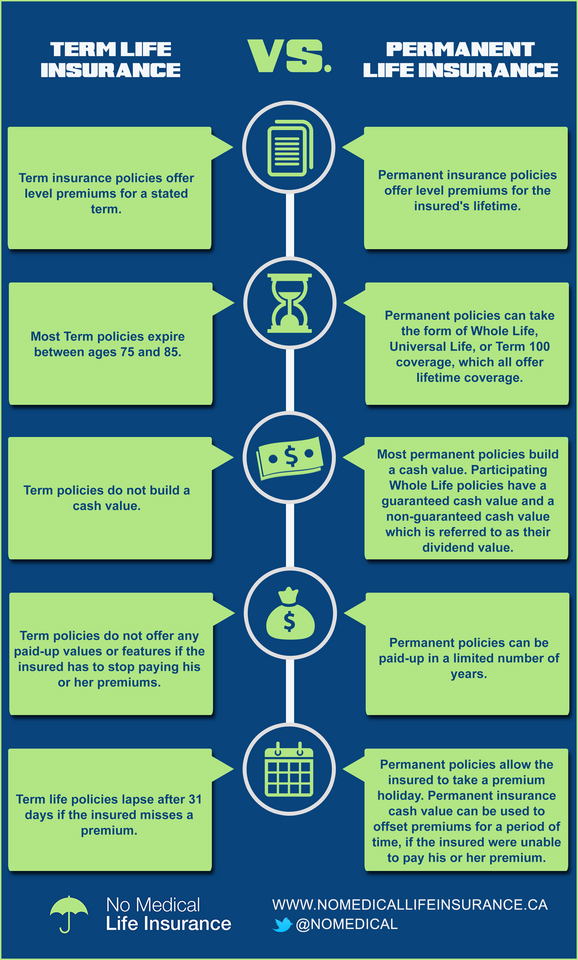

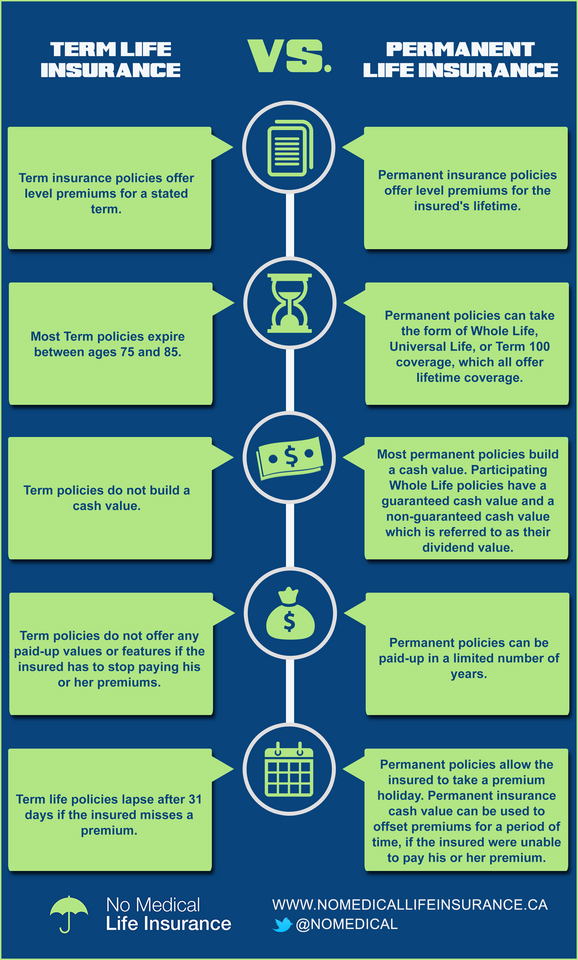

The majority of life insurance plans need a medical exam as part of the application procedure. Simplified problem and also ensured concerns are available for those with health problems that would certainly or else avoid them from obtaining a traditional policy. Long-term policies, such as entire life, include a savings element that gathers tax-deferred and may have higher costs than term life plans.

Whether offering a pure security strategy or a much more complicated life insurance policy plan, it is very important for a representative to fully understand the attributes of each item as well as how they associate with the customer's particular scenario. This helps them make enlightened referrals and prevent overselling.

Medical insurance

Health insurance is a system for funding medical expenses. It is commonly financed with contributions or tax obligations and also provided through personal insurers. Exclusive health insurance can be purchased separately or through group plans, such as those offered via companies or expert, public or spiritual teams. Some kinds of health coverage include indemnity strategies, which reimburse policyholders for particular costs up to a set restriction, handled care strategies, such as HMOs and also PPOs, and also self-insured strategies.

As a representative, it is important to understand the various types of insurance plan in order to help your customers locate the most effective choices for their needs as well as budgets. Nevertheless, blunders can take place, as well as if a mistake on your component triggers a client to lose cash, mistakes as well as omissions insurance policy can cover the price of the suit.

Long-Term Care Insurance Policy

Long-lasting care insurance helps people pay for home health assistant solutions and retirement home care. It can also cover a part of the expense for assisted living and also other household treatment. Plans normally cap how much they'll pay each day and over a person's lifetime. Some policies are standalone, while others integrate protection with various other insurance coverage items, such as life insurance policy or annuities, and also are known as hybrid policies.

please click the up coming article of private long-lasting treatment insurance policies need medical underwriting, which indicates the insurance provider requests personal info and may request documents from a physician. A preexisting condition might omit you from getting advantages or could trigger the policy to be terminated, professionals caution. Best Insurance For Off Road Vehicles provide a rising cost of living cyclist, which increases the daily advantage amount on an easy or compound basis.