SPOILER ALERT!

Recognizing The Different Types Of Insurance Plan As An Agent

Content writer-Perry Hunt

Insurance coverage is an essential investment that shields you and your properties from monetary loss. Insurance coverage agents and also firms can help you recognize the various types of insurance policies offered to fulfill your demands.

Representatives describe the various choices of insurance provider as well as can finish insurance sales (bind protection) on your behalf. Independent agents can work with numerous insurance coverage service providers, while hostage or exclusive insurance policy agents stand for a solitary business.

If you're seeking to acquire a particular type of insurance policy, you can connect with captive agents that work with one particular provider. These agents market just the plans supplied by their employer, which makes them professionals in the kinds of insurance coverage and also discount rates supplied.

They also have a strong connection with their business and also are typically required to fulfill sales quotas, which can influence their ability to assist clients objectively. They can offer a variety of policies that fit your demands, yet they will not have the ability to offer you with quotes from other insurance companies.

Restricted agents commonly collaborate with prominent insurance firms such as GEICO, State Farm and Allstate. They can be a wonderful source for customers that want to sustain neighborhood services and also establish a long-term connection with a representative that understands their area's distinct dangers.

Independent representatives generally work with multiple insurance companies to offer their customers' policies. This allows them to provide a more individualized as well as personalized experience for their customers. They can also help them re-evaluate their insurance coverage with time and also advise new policies based upon their requirements.

They can offer their customers a selection of plan alternatives from several insurance providers, which suggests they can give side-by-side contrasts of rates and coverage for them to choose from. They do this without any hidden agenda and also can help them discover the policy that truly fits their one-of-a-kind requirements.

The most effective independent agents recognize all the ins and outs of their numerous line of product and are able to answer any questions that show up for their clients. This is an important service as well as can conserve their customers time by taking care of all the information for them.

Life insurance policy policies usually pay money to assigned beneficiaries when the insured dies. The recipients can be an individual or business. Individuals can purchase life insurance policy policies directly from a private insurance company or through team life insurance policy supplied by employers.

https://blogfreely.net/alan07maya/top-7-methods-to-generate-leads-as-an-insurance-agent require a medical exam as part of the application process. Simplified What Does RV Insurance Cover and ensured problems are readily available for those with health problems that would certainly otherwise avoid them from getting a traditional plan. Irreversible plans, such as whole life, consist of a savings component that accumulates tax-deferred as well as might have higher costs than term life plans.

Whether selling a pure security strategy or an extra intricate life insurance plan, it's important for an agent to completely recognize the functions of each product as well as just how they associate with the customer's certain scenario. This helps them make enlightened recommendations and also stay clear of overselling.

Medical insurance is a system for financing clinical costs. It is normally funded with contributions or taxes and also supplied through personal insurance providers. Exclusive health insurance can be acquired individually or via group policies, such as those used through employers or specialist, civic or religious groups. Some kinds of health protection include indemnity strategies, which repay policyholders for certain expenses as much as an established limitation, managed care plans, such as HMOs and also PPOs, as well as self-insured strategies.

As an agent, it is very important to comprehend the various kinds of insurance policies in order to help your customers locate the most effective options for their demands and budget plans. However, blunders can occur, and also if an error on your part triggers a customer to shed money, mistakes and noninclusions insurance policy can cover the price of the fit.

Long-term care insurance coverage assists individuals pay for house wellness assistant solutions and also nursing home care. It can likewise cover a section of the expense for assisted living and also various other residential care. Policies typically cap just how much they'll pay each day and over an individual's life time. Some policies are standalone, while others incorporate coverage with other insurance coverage products, such as life insurance policy or annuities, and also are known as hybrid plans.

Numerous private long-term treatment insurance plan call for medical underwriting, which indicates the insurer requests for individual details and may request records from a doctor. https://www.wbrc.com/2023/02/28/former-blount-county-insurance-agent-accused-fraud/ preexisting problem could exclude you from getting benefits or may trigger the plan to be canceled, professionals alert. Some plans offer a rising cost of living biker, which raises the everyday benefit amount on an easy or compound basis.

Insurance coverage is an essential investment that shields you and your properties from monetary loss. Insurance coverage agents and also firms can help you recognize the various types of insurance policies offered to fulfill your demands.

Representatives describe the various choices of insurance provider as well as can finish insurance sales (bind protection) on your behalf. Independent agents can work with numerous insurance coverage service providers, while hostage or exclusive insurance policy agents stand for a solitary business.

Captive Representatives

If you're seeking to acquire a particular type of insurance policy, you can connect with captive agents that work with one particular provider. These agents market just the plans supplied by their employer, which makes them professionals in the kinds of insurance coverage and also discount rates supplied.

They also have a strong connection with their business and also are typically required to fulfill sales quotas, which can influence their ability to assist clients objectively. They can offer a variety of policies that fit your demands, yet they will not have the ability to offer you with quotes from other insurance companies.

Restricted agents commonly collaborate with prominent insurance firms such as GEICO, State Farm and Allstate. They can be a wonderful source for customers that want to sustain neighborhood services and also establish a long-term connection with a representative that understands their area's distinct dangers.

Independent Agents

Independent representatives generally work with multiple insurance companies to offer their customers' policies. This allows them to provide a more individualized as well as personalized experience for their customers. They can also help them re-evaluate their insurance coverage with time and also advise new policies based upon their requirements.

They can offer their customers a selection of plan alternatives from several insurance providers, which suggests they can give side-by-side contrasts of rates and coverage for them to choose from. They do this without any hidden agenda and also can help them discover the policy that truly fits their one-of-a-kind requirements.

The most effective independent agents recognize all the ins and outs of their numerous line of product and are able to answer any questions that show up for their clients. This is an important service as well as can conserve their customers time by taking care of all the information for them.

Life insurance policy

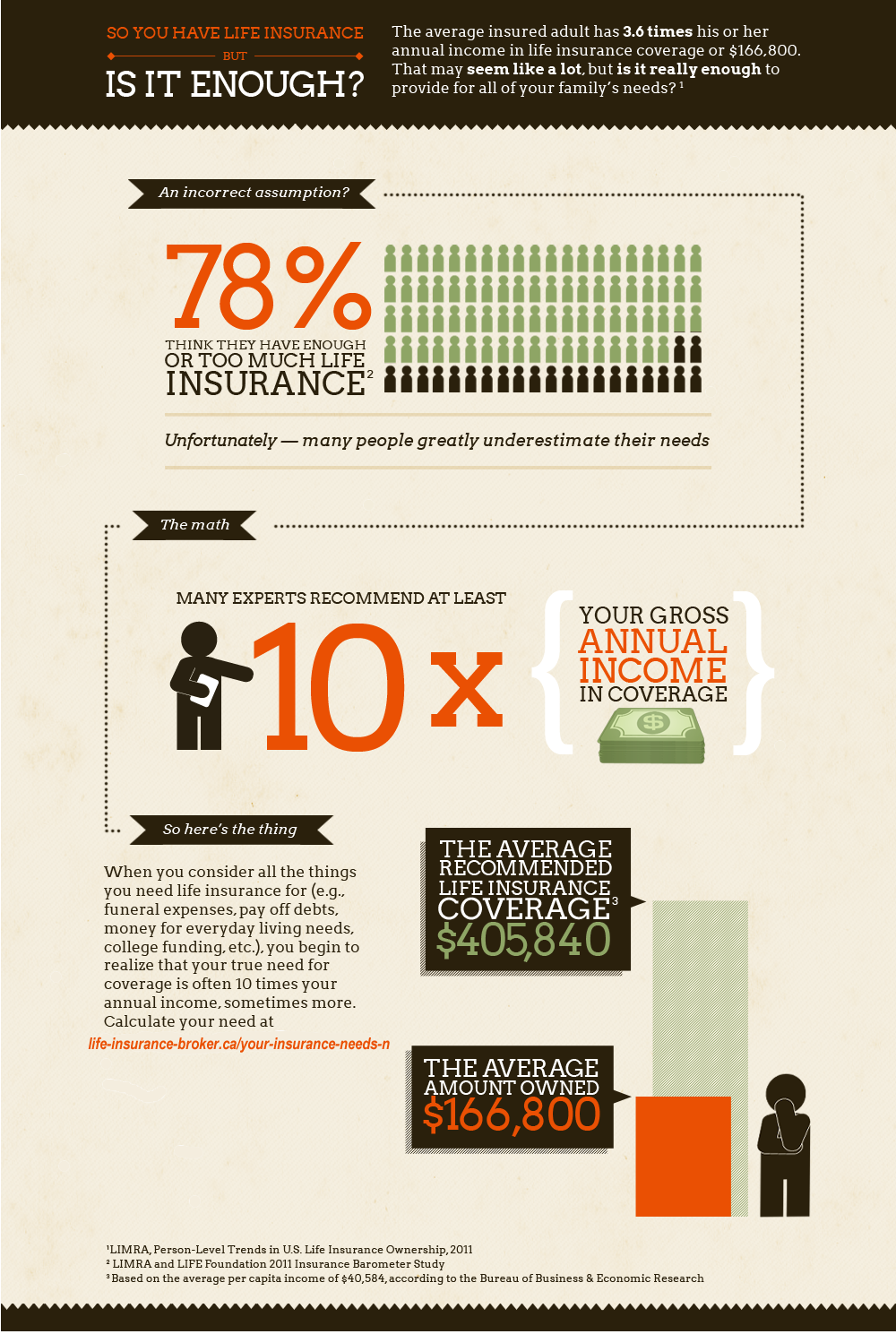

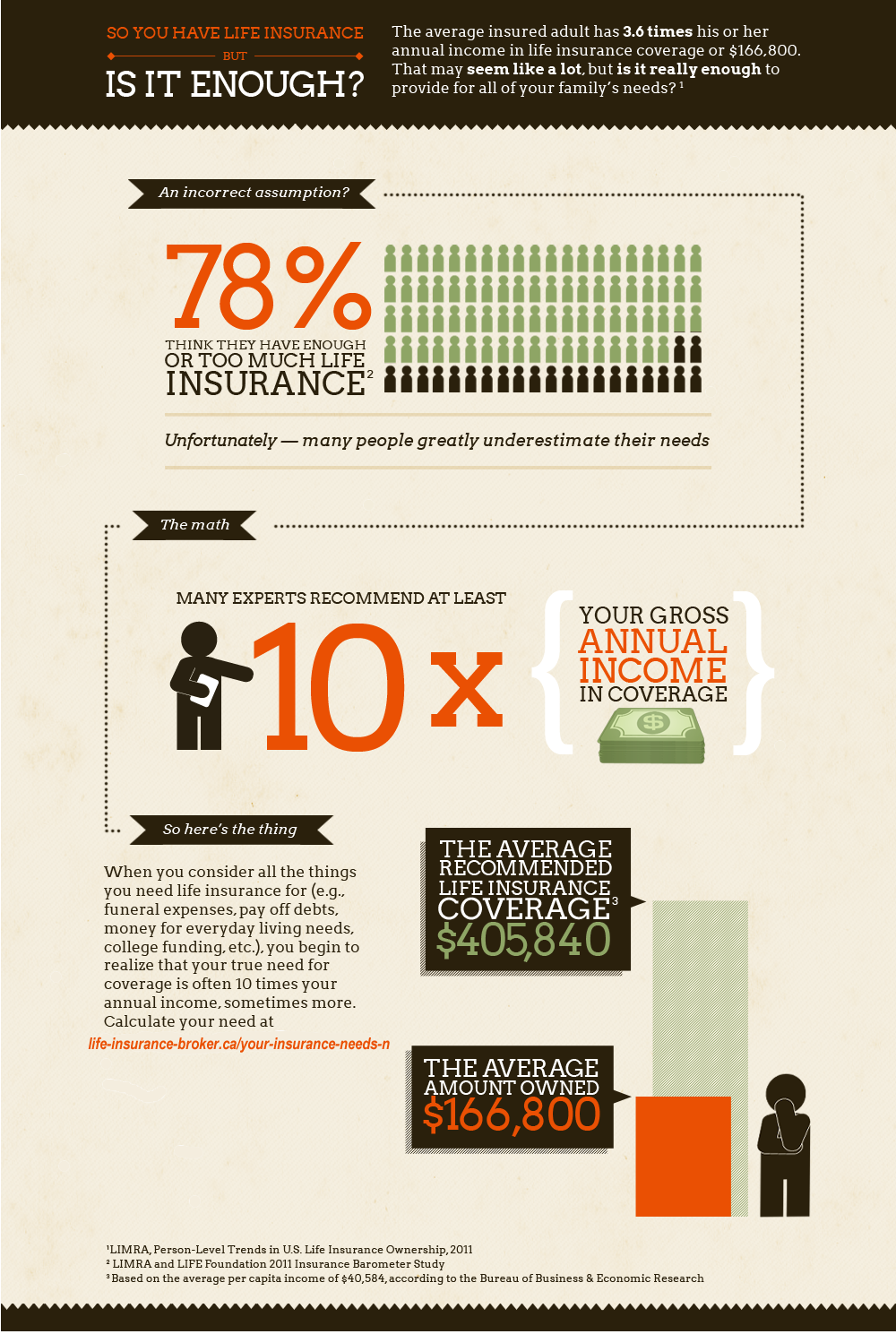

Life insurance policy policies usually pay money to assigned beneficiaries when the insured dies. The recipients can be an individual or business. Individuals can purchase life insurance policy policies directly from a private insurance company or through team life insurance policy supplied by employers.

https://blogfreely.net/alan07maya/top-7-methods-to-generate-leads-as-an-insurance-agent require a medical exam as part of the application process. Simplified What Does RV Insurance Cover and ensured problems are readily available for those with health problems that would certainly otherwise avoid them from getting a traditional plan. Irreversible plans, such as whole life, consist of a savings component that accumulates tax-deferred as well as might have higher costs than term life plans.

Whether selling a pure security strategy or an extra intricate life insurance plan, it's important for an agent to completely recognize the functions of each product as well as just how they associate with the customer's certain scenario. This helps them make enlightened recommendations and also stay clear of overselling.

Health Insurance

Medical insurance is a system for financing clinical costs. It is normally funded with contributions or taxes and also supplied through personal insurance providers. Exclusive health insurance can be acquired individually or via group policies, such as those used through employers or specialist, civic or religious groups. Some kinds of health protection include indemnity strategies, which repay policyholders for certain expenses as much as an established limitation, managed care plans, such as HMOs and also PPOs, as well as self-insured strategies.

As an agent, it is very important to comprehend the various kinds of insurance policies in order to help your customers locate the most effective options for their demands and budget plans. However, blunders can occur, and also if an error on your part triggers a customer to shed money, mistakes and noninclusions insurance policy can cover the price of the fit.

Long-Term Care Insurance Coverage

Long-term care insurance coverage assists individuals pay for house wellness assistant solutions and also nursing home care. It can likewise cover a section of the expense for assisted living and also various other residential care. Policies typically cap just how much they'll pay each day and over an individual's life time. Some policies are standalone, while others incorporate coverage with other insurance coverage products, such as life insurance policy or annuities, and also are known as hybrid plans.

Numerous private long-term treatment insurance plan call for medical underwriting, which indicates the insurer requests for individual details and may request records from a doctor. https://www.wbrc.com/2023/02/28/former-blount-county-insurance-agent-accused-fraud/ preexisting problem could exclude you from getting benefits or may trigger the plan to be canceled, professionals alert. Some plans offer a rising cost of living biker, which raises the everyday benefit amount on an easy or compound basis.